Controller vs. Comptroller: What’s the Real Difference?

In the world of finance, the titles Controller and Comptroller often cause confusion. Both roles are integral to financial management but serve distinct functions depending on the organization. Understanding these roles—and how they interact with the CFO—is essential for building a capable and focused financial team.

The Role of a Controller

A Controller is a senior financial officer typically found in for-profit organizations. Controllers ensure the organization’s financial health through precise management of accounting operations, compliance, and reporting.

To excel in these responsibilities, controllers often rely on support systems that automate manual tasks performed by accountants and bookkeepers. Staff augmentation services, for instance, provide trained professionals who specialize in streamlining back-office operations. This approach allows controllers to oversee critical functions while freeing their time to focus on strategic priorities like budgeting, financial planning, and compliance oversight.

Understanding the differences between bookkeeping and accounting is a key part of this support structure. Bookkeeping ensures accurate transaction recording, forming the foundation for accounting, which interprets financial data to provide actionable insights. With efficient systems and expert assistance in place, controllers can elevate their role and contribute to the organization’s broader financial success.

Core Responsibilities:

Financial Reporting: Produces accurate reports aligned with Generally Accepted Accounting Principles (GAAP).

Internal Controls: Implements systems to reduce errors and fraud while improving efficiency.

Budget Oversight: Develops and monitors budgets to align with organizational goals.

Team Leadership: Supervises accountants and financial analysts to maintain consistent operations.

Controllers play a key role in ensuring the accuracy of financial data and providing actionable insights to stakeholders.

What Is a Comptroller?

The Comptroller operates similarly to a controller but within government or non-profit organizations. Their work prioritizes transparency, public accountability, and adherence to regulations specific to managing public or donor funds.

Examining how various industries embrace outsourcing reveals how comptrollers tackle expanding responsibilities. Leading sectors like hospitality, healthcare, and retail rely on outsourced accounting to maintain compliance and precision. Non-profits, often navigating tight budgets and intricate regulations, gain immense value from these services.

Core Responsibilities:

Fund Management: Oversees the allocation and tracking of funds to ensure proper use.

Regulatory Compliance: Adheres to standards like those set by the Governmental Accounting Standards Board (GASB).

Auditing: Coordinates internal and external audits to validate financial accuracy.

Policy Implementation: Develops financial policies that align with organizational missions.

Comptrollers serve as the financial backbone of public-serving organizations, building trust through accountability.

Key Differences Between Controllers and Comptrollers

Sector of Operation

Controller: Primarily works in private or for-profit organizations.

Comptroller: Typically operates in government or non-profits.

Goals

Controller: Focused on profitability and operational efficiency.

Comptroller: Prioritizes accountability, compliance, and ethical fund management.

Compliance Standards

Controller: Follows GAAP and other standards for private organizations.

Comptroller: Adheres to GASB or similar regulations governing public funds.

Where Does the CFO Fit In?

The CFO (Chief Financial Officer) oversees the broader financial strategy of the organization, working closely with controllers and comptrollers. While controllers and comptrollers handle the details—such as reporting and compliance—the CFO uses this data to guide high-level decision-making, such as:

Developing long-term financial strategies.

Managing capital structure and investments.

Communicating financial performance to stakeholders.

Outsourcing CFO services has become increasingly common, especially in industries like food and beverage. With outsourced CFO services, organizations gain access to expert financial leadership without the overhead of a full-time hire. These services help address cash flow challenges, streamline compliance, and develop growth strategies, allowing CFOs to focus on steering the organization toward its goals.

How Controllers, Comptrollers, and CFOs Collaborate

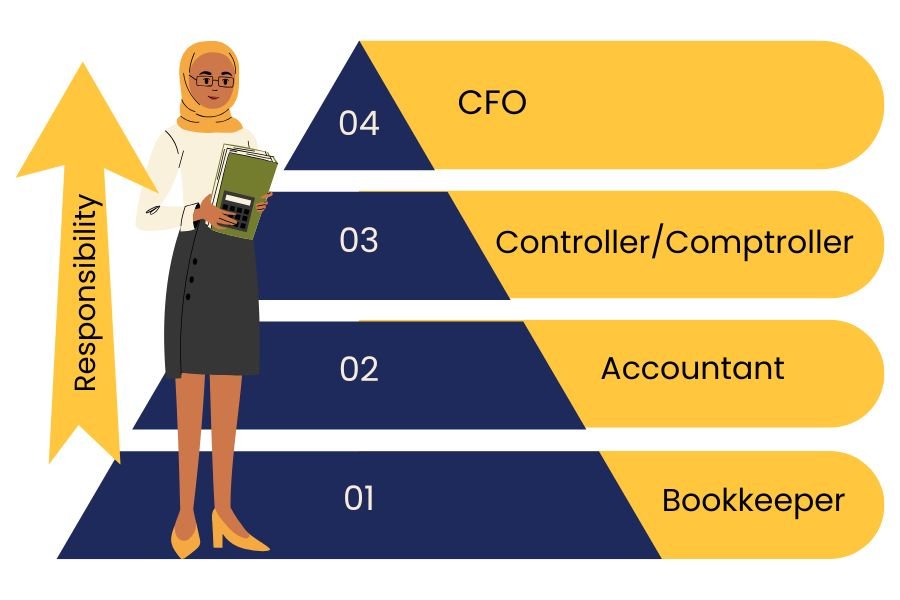

The accounting pyramid starts with bookkeepers at the base, handling daily transactions. Above them, accountants manage financial data, followed by controllers/comptrollers who oversee reporting and compliance. At the top, the CFO leads strategic financial decisions. Each level plays a critical role in the organization’s financial success, with increasing responsibilities as you move up the pyramid.

In organizations with complex financial structures, the roles of controllers, comptrollers, and CFOs intersect frequently:

Controllers and Comptrollers: Handle day-to-day financial management and compliance.

CFO: Relies on their data to make informed strategic decisions.

For example, a non-profit organization might have a comptroller ensuring compliance with donor restrictions, while the CFO uses the data provided to create fundraising strategies. Similarly, in a corporation, the controller ensures precise reporting, empowering the CFO to assess opportunities for growth.

Why the Distinction Matters

Understanding the nuances between these roles ensures organizations can assign responsibilities effectively and hire the right expertise. A well-defined financial structure reduces inefficiencies, enhances compliance, and supports strategic goals.

For example:

For-Profit Organizations: Controllers are essential for managing profit-driven accounting and reporting.

Government and Non-Profits: Comptrollers ensure funds are used responsibly and transparently.

Support for Financial Leaders

Whether you're a controller, comptroller, or CFO, managing financial operations can be overwhelming. At Over Easy Office (OEO), we specialize in empowering financial leaders with trained bookkeepers and accountants. By automating routine tasks like reconciliations, transaction processing, and financial reporting, we free up your time to focus on strategy and growth.

Contact us today to discover how OEO’s expert support can help streamline your financial operations and enhance your team’s efficiency.